信息源于:北京仲裁委员会

争议摘要

数字藏品即非同质化通证,是一种记录在区块链中的不可被复制、替代或分离的独一无二的数字权益凭证。数字藏品与比特币有相似之处,均可以被出售或是交易,不同之处在于,数字藏品因随附了艺术、人文价值,成为了独一无二的可识别资产。

数字藏品最早出现于2014年5月,第一个由剪辑视频形成的数字藏品售出了四美元的价格。此后,虽然关注的人不多,但区块链中仍有买家在交易数字藏品。2021年初爆红后,数字藏品的热度一直持续至今,其所具有的艺术、人文属性亦吸引了不少文体行业的爱好者、明星以及公司的追捧。

在中国,腾讯、字节跳动等互联网公司纷纷涉足数字藏品行业,数字藏品平台也如雨后春笋般出现,一些文艺社团亦将自己的作品在平台上“铸造”成数字藏品发行。

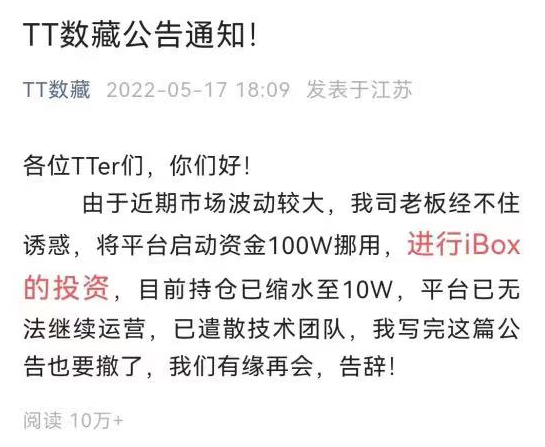

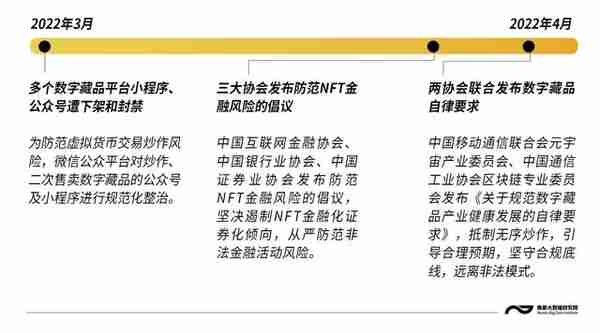

2022年11月11日,美国数字藏品交易平台FTX公司突然破产,使公众注意到了数字藏品交易的风险。其实,数字藏品自进入中国伊始,法律性质就备受争议。有学者认为其性质是虚拟货币,也有学者认为应是数字作品。上海法学会数字藏品课题组则认为,数字藏品不可简单地被认为是货币或是民法上的物,也不应简单地被认为是虚拟财产,而是应将其定义为加密数字凭证。但不论数字藏品的性质如何,各界都认同数字藏品将会有长足发展,且应加强对于其交易市场的监管。

2023年1月1日之前,数字藏品仅能够发行,但随着中国首个国家级合规数字资产二级交易平台“中国数字资产交易平台”的正式上线,数字藏品在中国进入到了可交易的时代。

这也得益于中国政府此前对于建立数字藏品二级交易市场的不断探索与创新,例如上海市曾于2022年7月12日颁布《上海市数字经济发展“十四五”规划》,明确提出:“支持龙头企业探索NFT交易平台。”香港特别行政区亦通过《有关香港虚拟货币发展的政策宣言》,明确支持数字藏品及加密货币的发展。

交易的存在意味着风险的存在,而这种交易风险则需要由专业的争议解决机制来予以化解。笔者认为,仲裁是十分适合解决数字藏品争议的纠纷解决机制,其理由如下:

首先,在面临新型的争议解决纠纷时,仲裁机构可以通过指定从事相关、相近领域或具备相应知识的仲裁员来审理该纠纷。

其次,数字藏品争议由于数字藏品本身的性质具有复合性,在处理数字藏品争议时可能需要审理者同时拥有处理知识产权、物权、证券等法律问题的能力以及对于信息技术、媒体等行业领域的专业知识。仲裁机构可以通过定期举办仲裁员沙龙或学习讨论会的方式,让上述领域的专家们进行交流、学习,从而培养一批拥有解决数字藏品争议能力的仲裁员队伍。

最后,在面对新兴的交易领域时,在暂时还没有强制性或效力性法律法规规制的前提下,需要审理者有较强商事思维来规制、保护以及促进相关交易的发展。商事仲裁产生于商事交易亦反哺于商事交易,促进商事交易一直就是商事仲裁逻辑和思维的出发点。

综上,仲裁机构在处理新型交易问题时具有明显优势。在中国数字资产交易平台设立的大背景下,为响应国家《关于推进实施国家文化数字化战略的意见》,应让仲裁机构助力于保障数字藏品交易安全、促进数字藏品交易的发展。

Arbitration institutions may support resolving NFT disputes

Anon-fungible token (NFT) is a unique digital certificate of entitlement recorded in the blockchain that cannot be copied, replaced or separated. It is similar to bitcoin in that both can be sold and traded, but unlike bitcoin, NFTs are unique and identifiable assets because of the artistic, societal and cultural values attached to them.

NFTs first appeared in May 2014, in the form of a video clip that was sold for USD4. While not attracting much wider attention, NFTs began to be traded by some buyers in the blockchain. NFTs’ big breakthrough came at the beginning of 2021, and since then their artistic, societal and cultural attributes have attracted celebrities, businesses and enthusiasts in cultural, sports and other areas.

In China, tech giants such as Tencent and ByteDance have ventured into the NFT industry. With the subsequent mushrooming of NFT platforms, some literary and artistic bodies in China turned their works into NFTs and distributed them via such platforms.

On 11 Nov 2022, FTX, an NFT trading platform in the US, unexpectedly went bankrupt, bringing everyone’s attention to the risks of trading NFTs. But there have been controversies concerning NFTs’ attributes since their very beginning.

In China, some scholars believe that they are a virtual currency, while others argue that they are digital works. The NFT Group of Shanghai Law Society proposes that NFTs should not be simply taken as currency or civil law objects, nor should they be classified as virtual properties. Instead, they should be defined as encrypted digital certificates.

Nevertheless, regardless of NFTs’ nature, it is widely agreed that they will continue to grow, and that NFT trading markets should be further regulated.

Before 1 January 2023, NFTs could only be distributed. However, with the official launch of China’s first national compliance platform for secondary trading of digital assets, the China Digital Asset Trading Platform, NFT transactions are now regulated.

This measure benefitted from the government’s innovation of establishing a secondary market for NFTs. The 14th Five-year Plan for the Development of Digital Economy in Shanghai, released on 12 July 2022, states clearly that it will “support leading enterprises in exploring NFT trading platforms”.

The Policy Statement on the Development of Virtual Currencies in Hong Kong is also explicitly supportive of the development of NFTs and cryptocurrencies.

Trading comes with risks, which are handled with professional dispute resolution mechanisms. Arbitration as a resolution mechanism is well suited to resolving disputes over NFTs for the following reasons.

First of all, in the face of new disputes over resolution, arbitration institutions may appoint an arbitrator who is engaged in a related/similar field, or who has the appropriate knowledge to settle the corresponding disputes.

Second, due to the inherent attributes of NFTs, disputes over them are complex and may require the arbitrators to have the ability to handle legal issues involving intellectual property, property rights and securities, as well as expertise in such industry sectors as information technology and media.

Arbitration institutions may hold regular salons or seminars for experts in the above-mentioned fields, which provides opportunities for exchanges and mutual learning to equip them with a team of arbitrators who are fully competent in solving disputes related to NFTs.

In the end, when facing emerging transaction issues, in the absence of mandatory or effective laws and regulations, the arbitrators should be equipped with a clear commercial mindset to regulate, protect and promote the relevant transactions.

Arbitration arises from commercial transactions and is intended to return the favour to them. The promotion of commercial transactions has always been the starting point of arbitration logic and thinking.

In summary, arbitration institutions have obvious advantages in handling new types of trading. In light of the establishment of the Digital Asset Trading Platform in China, and in response to the Opinions on Promoting the Implementation of the Cultural Digitization Strategy of China, we should enable arbitration institutions to help ensure the security of NFT transactions and promote their development.

作者 | 北京仲裁委员会/北京国际仲裁中心顾问付翔宇

本文刊载于《商法》2023年2月刊。如欲阅读电子版,欢迎浏览《商法》官网。