文 / 柳下婴(微信公众号:王不留)

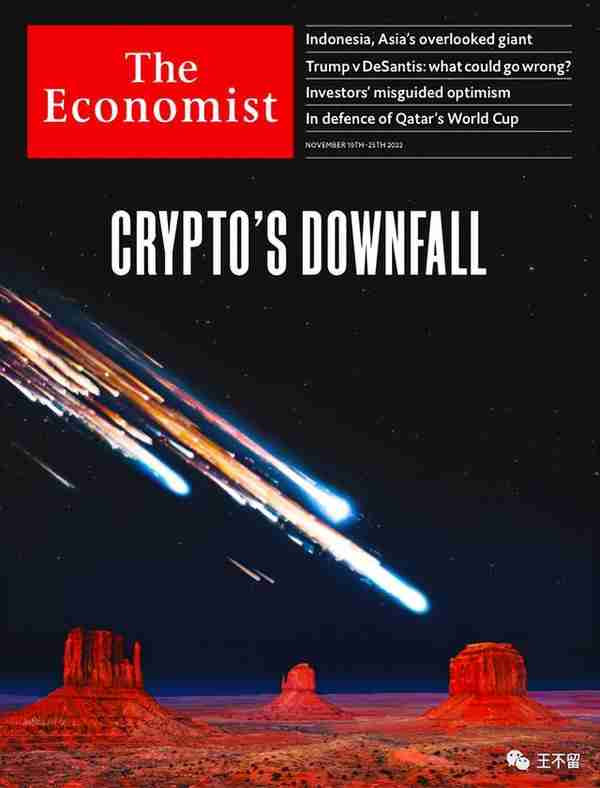

选自TE20221119,Leaders

Crypto's downfall

加密币大厦将倾

Is this the end of crypto? The collapse of FTX has dealt a catastrophic blow to crypto’s reputation and aspirations.

加密币的末日来临了吗?毋容置疑,FTX的破产对加密货币的声誉和抱负都造成了灾难性的打击。

The fall from grace was hard and fast. Only a fortnight ago Sam Bankman-Fried was in the stratosphere. FTX, his cryptocurrency exchange, then the third-largest, was valued at $32bn; his own wealth was estimated at $16bn. To the gushing venture capitalists (VCs) of Silicon Valley he was the financial genius who could wow investors while playing video games, destined, perhaps, to become the world’s first trillionaire. In Washington he was the acceptable face of crypto, communing with lawmakers and bankrolling efforts to influence its regulation.

从云端跌落,已成定局。就在两周前,山姆·班克曼·弗雷德(Sam Bankman-Fried,简称SBF,量化交易团队Alameda Research创始人,FTX联合创始人、前CEO。——译者注)还高高在上。他当时的第三大加密货币交易所FTX的估值为320亿美元,而他的个人财富估计有160亿美元。相对于硅谷那些夸夸其谈的风险资本家,他是一位金融天才,可以一边玩电子游戏,一边让投资者惊叹不已,也许他注定会成为世界上第一个万亿富翁。在华盛顿,他是公认的加密货币代言人,他与立法者交流,并提供资金对加密货币加强监管。

Today there is nothing left but 1m furious creditors, dozens of shaky crypto firms and a proliferation of regulatory and criminal probes. The high-speed implosion of FTX has dealt a catastrophic blow to an industry with a history of failure and scandals. Never before has crypto looked so criminal, wasteful and useless.

如今,除了100万愤怒的债权人、数十家摇摇欲坠的加密公司和与日俱增的监管及刑事调查之外,什么都没有了。这个行业本来就有一个不成功和不光彩的历史,现在FTX内部突然发生爆炸性事件,造成的打击是灾难性的。加密币从来没有像今天这样罪恶、浪费和无用。

The more that comes out about the demise of FTX, the more shocking the tale becomes. The exchange’s own terms of service said it would not lend customers’ assets to its trading arm. Yet of $14bn of such assets, it had reportedly lent $8bn-worth to Alameda Research, a trading firm also owned by Mr Bankman-Fried. In turn, it accepted as collateral its own digital tokens, which it had conjured out of thin air. A fatal run on the exchange exposed the gaping hole in its balance-sheet. To cap it all, after FTX declared bankruptcy in America, hundreds of millions of dollars mysteriously flowed out of its accounts.

关于FTX倒闭的报道越多,这个故事就越耸人听闻。该交易所自己的服务条款表示,不会将客户的资产出借给其交易部门。然而,据报道,FTX将价值达140亿美元客户资产中的80亿出借给了同样是SBF所有的阿拉米达研究(Alameda Research)贸易公司。反过来,它又接受了自己凭空变出来的数字加密币作为抵押品。一场致命的挤兑暴露了其资产负债表上的大窟窿。更糟糕的是,FTX在美国宣布破产后,数以亿计的美元神秘地从它的账户中流出。

Big personalities, incestuous loans, overnight collapses—these are the stuff of classic financial manias, from tulip fever in 17th-century Holland to the South Sea Bubble in 18th-century Britain to America’s banking crises in the early 1900s. At its peak last year, the market value of all cryptocurrencies surged to the giddy height of almost $3trn, up from nearly $800bn at the start of 2021. Today it is back at $830bn.

风云人物,互换贷款,一夜崩溃……这些都是金融狂热的典型表现,从17世纪荷兰的郁金香热到18世纪英国的南海泡沫,再到20世纪初美国的银行危机。在去年巅峰时期,加密币的总市值从2021年初的近8000亿美元飙升至近3万亿美元的令人眼花缭乱的高度。如今,它又回到了8300亿美元。

As at the end of any mania, the question now is whether crypto can ever be useful for anything other than scams and speculation. The promise was of a technology that could make financial intermediation faster, cheaper and more efficient. Each new scandal that erupts makes it more likely that genuine innovators will be frightened off and the industry will dwindle. Yet a chance remains, diminishing though it is, that some lasting innovation will one day emerge. As crypto falls to Earth, that slim chance should be kept alive.

就像所有狂热的结局一样,现在的问题是,加密货币除了用来行骗和投机,是否还能发挥别的作用。希望有这样一种技术,可以使金融中介更快,更便宜,更有效。每爆发一个新的丑闻,都可能会让真正的创新者知难而退,而这个行业也会逐渐萎缩。然而,尽管机会渺茫,但将来有一天仍有可能会出现一些持久的创新。既然加密币已经从云端跌落,那么这种微弱的机会就更应该保留下来。

Amid the wreckage of the past week, it is worth remembering the technology’s underlying potential. Conventional banking requires a vast infrastructure to maintain trust between strangers. This is expensive and is often captured by insiders who take a cut. Public blockchains, by contrast, are built on a network of computers, making their transactions transparent and, in theory, trustworthy. Interoperable, open-source functions can be built on top of them, including self-executing smart contracts that are guaranteed to function as written. A system of tokens, and rules governing them, can collectively offer a clever way to incentivise open-source contributors. And arrangements that would be expensive or impractical to enforce in the real world become possible—allowing artists to retain a stake in the profits from the resale of their digital works, for instance.

在过去一周的这场浩劫中,值得人们牢记的是这项技术有着无穷的潜力。传统的银行业需要庞大的基础设施来维持陌生人之间的信任。这是昂贵的,而且这种信任还往往被趁火打劫的内部人士所利用。相比之下,公共区块链建立在计算机网络上,其交易更加透明,因而在理论上更值得信赖。在此基础之上,可以再增加可互操作的开源代码功能,包括保证按编写状态运行的自执行智能合约。一系列代币和管理代币的规则可以共同提供一种智能的方式,以激励开源贡献者。而那些在现实世界中执行起来既昂贵又不切实际的安排也成为可能——例如,允许艺术家从他们的数字作品的转售中保留一部分利润。

The disappointment is that, 14 years after the Bitcoin blockchain was invented, little of this promise has been realised. Crypto’s frenzy drew in talent from bright graduates to Wall Street professionals, and capital from VC firms, sovereign-wealth and pension funds. Vast quantities of money, time, talent and energy have been used to build what amount to virtual casinos. Efficient, decentralised versions of mainstream financial functions, such as currency exchanges and lending, exist. But many consumers, fearful of losing their money, do not trust them. Instead, they are used to speculate on unstable tokens. Money-launderers, sanctions-dodgers and scammers abound.

令人失望的是,比特币区块链发明14年后,这一承诺几乎没有实现。加密货币狂热吸引了大量的人才——从聪明的毕业生到华尔街专业人士——以及来自风投公司、主权财富基金和养老基金的资本。大量的金钱、时间、人才和精力被用来建立相当于是一个虚拟赌场的东西。相对于主流金融的货币兑换和贷款等功能,它更加高效与分散(安全)。但是,许多消费者害怕失去他们的金钱,不信任他们。相反,它们被用来对不稳定的代币进行推测。结果,洗钱者、逃避制裁者和骗子比比皆是。

Presented with all this, a sceptic might say that now is the time to regulate the industry out of existence. But a capitalist society should allow investors to take risks in the knowledge that they will make losses if their bets go sour. Even as crypto has imploded, the spillovers to the wider financial system have been manageable. FTX’s backers included Sequoia, a Californian VC firm; Temasek, a Singaporean sovereign-wealth fund; and the Ontario Teachers’ Pension Plan. All have lost money, but none catastrophically.

在这一形势下,持怀疑态度的人可能会说,现在是对这个行业进行监管的时候了。但资本主义社会应该允许投资者承担风险,因为他们知道,如果他们的押错赌注,就应蒙受损失。尽管加密货币已经崩溃,但是它对更广泛金融体系的溢出效应是可控的。FTX的支持者包括加州风险投资公司红杉资本(Sequoia)、新加坡主权财富基金淡马锡(Temasek)以及安省教师退休金计划(Ontario Teachers' Pension Plan)。它们都亏损了,但是并没有到灾难性的程度。

Moreover, sceptics should acknowledge that nobody can predict which innovations will bear fruit and which will not. People should be free to devote time and money to fusion power, airships, the metaverse and a host of other technologies that may never come good. Crypto is no different. As the virtual economy develops, useful decentralised applications may yet appear—who knows? The underlying technology continues to improve. An upgrade to Ethereum’s blockchain in September radically reduced its energy consumption, paving the way for it to handle high transaction volumes efficiently.

此外,怀疑论者应该承认,没有人能预测哪些创新会结出丰硕成果,哪些会一无所获。人们尽可以自由地把时间和金钱投入到核聚变发电、飞艇、元宇宙和许多其它可能永远不会有好结果的技术上。加密币也不例外。随着虚拟经济的发展,一些大有可为的去中心化应用可能会出现——这谁能说得清?底层技术在不断完善。9月对以太坊区块链的升级从根本上降低了它的能源消耗,为它高效处理高交易量铺平了道路。

Instead of over-regulating or stamping out crypto, regulators should be guided by two principles. One is to ensure that theft and fraud are minimised, as with any financial activity. The other is to keep the mainstream financial system insulated from further crypto-ructions. Although blockchains were explicitly designed to escape regulation, these principles justify regulating the institutions that act as gatekeepers for the cryptosphere. Requiring exchanges to back customer deposits with liquid assets is an obvious step. A second is disclosure rules that reveal if, say, a gargantuan and dubiously collateralised loan has been made to the exchange’s own trading arm. Stablecoins, which are meant to hold their value in real-world currency, should be regulated as if they were payment instruments at banks.

此时,监管机构要做的不是对加密币进行过度监管甚至完全封杀,而是应该遵循以下两个原则。一是确保将盗窃和欺诈行为减少到最低限度,就像任何金融活动一样。另一个是保持主流金融系统不受进一步加密动荡的影响。虽然区块链的设计显然是为了逃避监管,但这些原则也证明了监管机构的正当性,这些机构充当了密码层的守门人。要求交易所为客户存款提供流动资产支持就是一个明显的措施。第二个是披露规则,即比如说,有人向交易所自己的交易部门提供了巨额且可疑的抵押贷款,这个就必须予以披露。稳定币(一种加密货币——译者注),它的本意就是以真实货币的形式实现保值,对于它的监管就应该将它视同于银行的支付工具。

Tulip bulb or light bulb?

是郁金香球茎还是灯泡?(是一夜暴富还是黄粱一梦?)(参看文末“知识链接”)

Whether crypto survives, or becomes a financial curiosity like the tulip bulb, will not ultimately depend on regulation. The more scandals ensue, the more the whole enterprise and its aspirations become tainted. The lure of innovation means nothing if investors and users fear their money will disappear into thin air. For crypto to rise again, it must find a valid use that leaves the dodginess behind.

加密货币的命运是继续生存,还是将成为像郁金香球茎那样的金融奇事,这最终不取决于监管。丑闻越多,整个企业及其远大抱负就越容易被玷污。如果投资者和用户担心他们的钱会凭空消失,创新的吸引力就会变得毫无意义。加密货币如果想重新崛起,就必须找到一个能规避风险的正当用途。

柳下婴知识链接

tulip bulb:郁金香球茎。此处指经济学历史上著名的郁金香泡沫案,又称郁金香效应。这一事件发生在17世纪的荷兰,是人类历史上有记载以来的最早投机活动。

自此潘多拉魔盒被打开,什么羊群效应、趋之若鹜、理性丧失、泡沫破灭、倾家荡产等剧情轮番上演,构成了一幅波澜壮阔的长达300多年的金融风云画卷。

16世纪中期,郁金香从土耳其被引入西欧。当郁金香开始在荷兰流传后,一些机敏的投机商就开始大量囤积郁金香球茎以待价格上涨。不久,在舆论的鼓吹之下,人们对郁金香表现出一种病态的倾慕与热忱,并开始竞相抢购郁金香球茎。

受暴利驱使,所有的人都冲昏了头脑。他们变卖家产,只是为了购买一株郁金香。就在1636这一年,为了方便郁金香交易,人们干脆在阿姆斯特丹的证券交易所内开设了固定的交易市场。

到1637年,郁金香的价格已经涨到了骇人听闻的水平。与上一年相比,郁金香总涨幅高达5900%!1637年2月,一株名为“永远的奥古斯都”的郁金香售价高达6700荷兰盾,这笔钱足以买下阿姆斯特丹运河边的一幢豪宅,而当时荷兰人的平均年收入只有150荷兰盾。

就当人们沉浸在郁金香狂热中时,一场大崩溃已经近在眼前。由于卖方突然大量抛售,公众开始陷入恐慌,导致郁金香市场在1637年2月4日突然崩溃。一夜之间,郁金香球茎的价格一泻千里。

虽然荷兰政府发出紧急声明,认为郁金香球茎价格无理由下跌,劝告市民停止抛售,并试图以合同价格的10%来了结所有的合同,但这些努力毫无用处。一个星期后,郁金香的价格已平均下跌了90%,而那些普通的品种甚至不如一颗洋葱的售价。

绝望之中,人们纷纷涌向法院,希望能够借助法律的力量挽回损失。但在1637年4月,荷兰政府决定终止所有合同,禁止投机式的郁金香交易,从而彻底击破了这次历史上空前的经济泡沫。

王不留注

柳下婴老师是我认识的英语大佬之一,擅长外文翻译,爱看《经济学人》。

根据不少考研朋友的建议,现在将其翻译作品,上传到百度网盘,在“柳下婴精翻系列”中,以PDF方式免费分享。欢迎下载。谢谢。